Mastering Naked Trading: Harnessing Market Profile for Price Action Insights

In the ever-evolving landscape of financial markets, traders are constantly seeking an edge, a methodology that provides clarity amidst the chaos of price movements. Enter naked trading, a concept that might sound risky at first glance but is, in fact, a disciplined approach grounded in reading pure price action. By eschewing lagging indicators and focusing solely on market-generated information, particularly through the lens of market profile analysis, traders can unlock a deeper understanding of market dynamics and make more informed trading decisions.

Understanding Naked Trading

Naked trading is a trading style that relies solely on price charts without the use of any technical indicators. Instead of relying on lagging signals generated by indicators, naked traders interpret raw price movements to identify patterns, trends, and potential reversal points. This approach is often favored by experienced traders who understand the nuances of market behavior and appreciate the simplicity and clarity it offers.

The Power of Market Profile

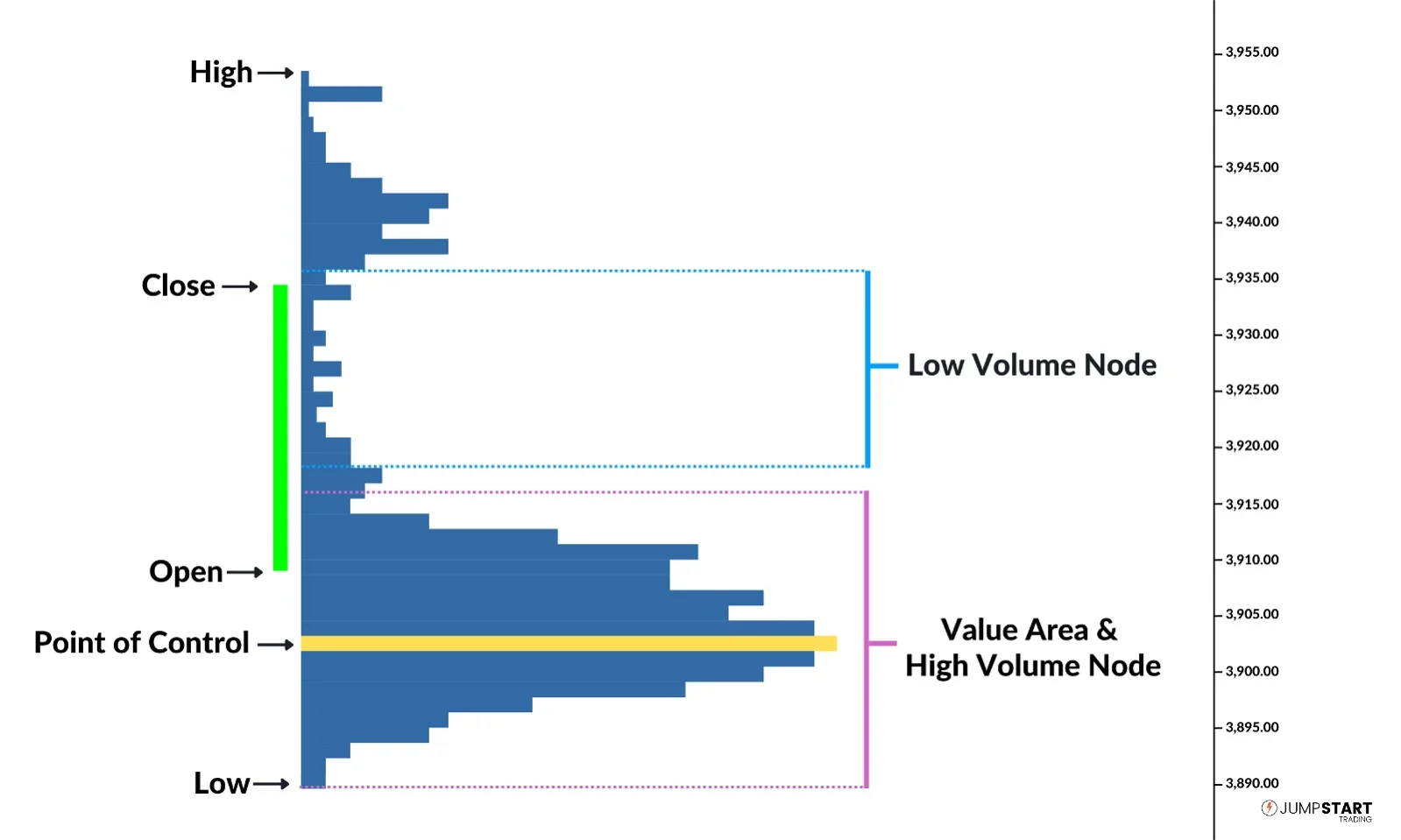

At the heart of naked trading lies the market profile, a powerful tool for analyzing the distribution of trading activity over time at various price levels. Market profile charts visualize where the majority of trading activity occurs, providing valuable insights into market sentiment, supply and demand dynamics, and potential areas of support and resistance.

Market profile analysis divides the trading day into distinct periods, typically using 30-minute intervals, and plots the volume traded at each price level within those periods. This creates a profile of the market’s behavior, highlighting areas where price has spent significant time (value areas) and areas where it has quickly moved through (thin areas).

Reading Price Action with Market Profile

Naked trading with market profile involves observing how price interacts with key levels identified on the market profile chart. Here are some key principles:

- Value Areas: Focus on price movements within value areas, as these are areas where the market has found equilibrium and significant trading activity has occurred. Price often rotates within these areas, providing opportunities for intraday trades.

- Point of Control (POC): The POC represents the price level with the highest volume traded during a specific period. It acts as a magnet for price, often serving as a support or resistance level. Traders watch for price reactions around the POC for potential trading opportunities.

- Developing vs. Established Value Areas: Distinguishing between developing and established value areas is crucial. Developing value areas indicate areas where price is currently exploring and may offer potential breakout opportunities, while established value areas suggest areas of consolidation and potential range-bound trading.

- Volume Profile: Combining market profile analysis with volume profile can provide additional confirmation for trading decisions. High volume nodes (areas with significant volume) often act as strong support or resistance levels, adding confluence to trading setups.

Executing Trades with Confidence

Trading naked with market profile requires discipline, patience, and a deep understanding of market dynamics. Here are some tips for executing trades with confidence:

- Wait for Confirmation: Avoid jumping into trades impulsively. Wait for price confirmation, such as a candlestick pattern or a significant break of a key level, before entering a trade.

- Manage Risk: Set clear stop-loss levels based on market structure and volatility. Always ensure that potential rewards outweigh the risks before entering a trade.

- Stay Flexible: Markets are dynamic and constantly evolving. Be prepared to adapt your trading strategy based on changing market conditions and new information provided by the market profile.

- Continuous Learning: Mastering naked trading with market profile is an ongoing process. Continuously educate yourself, analyze your trades, and refine your approach to improve your trading results over time.

Conclusion

Naked trading with market profile offers a refreshing alternative to traditional indicator-based approaches, providing traders with a deeper understanding of market dynamics and clearer insights into price action. By focusing on market-generated information and leveraging the power of market profile analysis, traders can develop a robust trading strategy that allows them to navigate the markets with confidence and consistency. As with any trading methodology, success lies in discipline, patience, and a commitment to continuous learning and improvement.

Happy Trading!!

Audioblog: 4:49

Resources

Trading Naked – The Book:

https://structure2trade.com/trading-training-courses/trading-naked-the-book/

Full Volume Profile Tutorial For Tradingview Platform

https://www.tradingview.com/support/solutions/43000502040-volume-profile-indicators-basic-concepts/

Sample Execution – YouTube

14 Days Trial Offer: $2.99